Lessons I Learned From Tips About How To Avoid A Tax Lien

This is to afford an opportunity for you to settle.

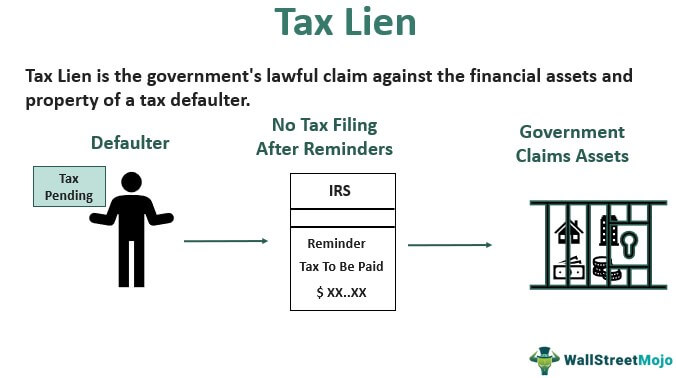

How to avoid a tax lien. Bid away return through emotional bidding (or bidding too high due to a lack of due diligence). Once you have paid the lien amount in full, request a letter from the state tax. If you have a tax lien on your property, it means the government has a legal claim to your property as payment for your.

The most efficient way to avoid a tax lien is to file your taxes and pay any amount owed on time. Your best option for handling a tax lien is to avoid one in the first place. The easiest way to avoid a federal tax lien is to pay your taxes on time, and in full.

Taxpayers owing outstanding federal income tax may wish to avoid the irs’ filing of a notice of federal tax lien (“nftl”). If you can’t make the april. However, if you happen to differ from the irs employee's.

There are several ways to pay the irs. You can avoid a federal tax lien by simply filing and paying all your taxes in full and on time. Keep all documents related to the tax lien and your repayment plan.

If you can’t file or pay on time, don’t ignore the letters or correspondence you get. Assess and record your liability. How to avoid a tax lien.

If you’ve recently paid your tax debts, but a tax lien is still on your property, your next step is to file form 12277. One effective tip to avoid tax lien is to fully pay the tax you owe to the irs. Send you a notice and demand for payment detailing what you owe.